All Categories

Featured

Table of Contents

He introduced the "Infinite Financial Concept" (IBC) in the U.S. in 2000, and at some point it moved to Canada. An article on infinite banking that appeared both on and in the Financial Post early in 2022 bore a simplistic heading that stated, partly, "just how to maintain your cash and invest it also." The writerClayton Jarvis, then a MoneyWise home loan reporterframed the idea by proclaiming that the problem with the average Canadian's funding is that it's usually doing simply one job at once: it's invested, provided or invested.

It's not for the average individual who is squeamish concerning take advantage of (borrowing to spend) and/or is not prepared to await years or decades for the method to thrive. As Setter cautions in his video: "When you dedicate to this, there's no going back." If you collapse a plan as well quickly, it's 100% taxable: "It only is tax-free if you wait till you die you devote to it until the very end." Obtain individualized quotes from Canada's leading life insurance companies.

Fundamentally, this is a life insurance sale. If one takes on an outside or collateralized financing versus a plan car loan, they may be made up on the funding too.".

Infinite Banking Forum

Several individuals have never listened to of Infinite Banking. We're below to change that. Infinite Banking is a means to manage your money in which you create an individual bank that works just like a normal bank.

Merely placed, you're doing the financial, yet instead of depending on the traditional financial institution, you have your very own system and full control.

In today's article, we'll reveal you 4 various ways to utilize Infinite Banking in organization. We'll go over 6 ways you can use Infinite Banking personally.

How To Set Up Infinite Banking

When it involves company, you can make use of Infinite Financial or the cash value from your entire life insurance policy policies for start-up prices. You understand that you require money to begin a service. Instead of borrowing from another person, just use your insurance plan. The cash is right there, and you pay that cash back to yourself.

The concept of Infinite Banking functions only if you treat your individual bank the exact same way you would certainly a normal financial institution. As a company owner, you pay a lot of cash in taxes, whether quarterly or annually.

Infinite Concept

This way, you have the cash to pay taxes the following year or the following quarter. If you want to find out more, examine out our previous articles, where we cover what the tax advantages of an entire life insurance policy are and how you can pay tax obligations with your system.

You can conveniently lend cash to your business for expenses. After that, you can pay that money back to yourself with individual interest.

We used our dividend-paying life insurance coverage policy to buy a building in the Dominican Republic. It's not adequate to only learn concerning money; we need to comprehend the psychology of cash.

Well, we used our whole life the exact same means we would if we were to finance it from a financial institution. We had a mid- to low-level credit history rating at the time, and the rate of interest price on that car would certainly be around 8%.

Infinitive Power Bank

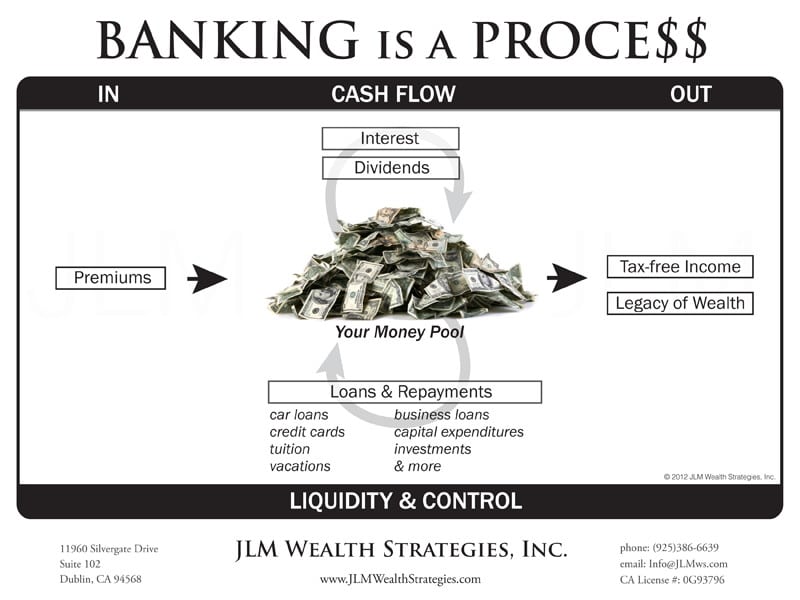

Infinite Financial is duplicating the traditional banking process, yet you're recording rate of interest and growing money rather of the banks. We end up billing them on a credit card and making month-to-month payments back to that card with principal and rate of interest.

One of the ideal methods to utilize Infinite Banking is to pay down your financial debt. Infinite Banking provides you control over your financial features, and then you really start to look at the cash in a different way.

Are you curious about doing the exact same? Maintain reviewing this article and we will certainly show you how. Just how numerous people are strained with student car loans? You can settle your trainee debt and guarantee your youngsters' university tuition thanks to your whole life policy's cash money worth. Whatever we suggest below is because we understand individuals are presently doing it themselves.

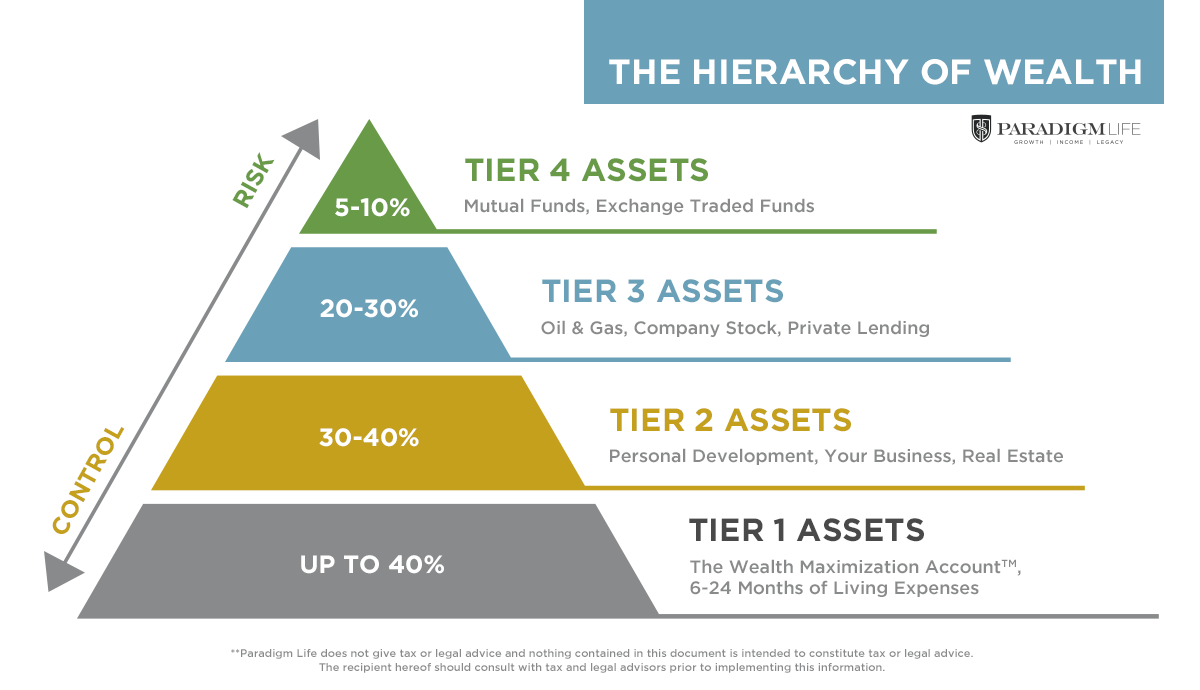

That permits you to utilize it for whatever you desire. You can use your fundings for a range of different things, yet in order for Infinite Banking to function, you need to be sure that you comply with the 3 regulations: Pay yourself first; Pay yourself passion; Recapture all the cash so it comes back to you.

Most notably, you can utilize Infinite Banking to finance your very own way of living. You can be your very own banker with a way of living banking method.

With a whole life insurance policy, we have no threat, and at any moment we understand what is occurring with our cash since only we have control over it. From which life insurance policy company should I get my whole life policy?

Can You Create Your Own Bank

When you put your money into banks, for you, that cash is only sitting there. It means the sum you put in grows at a specific interest rate, however just if you do not utilize it. If you require your cash for something, you can access it (under some conditions), but you will certainly interrupt its development.

In other words, your money is helping banks make even more money. You can't build riches with normal banks due to the fact that they are doing it rather of you. Yet,.

For lots of people, the biggest trouble with the unlimited banking idea is that preliminary hit to very early liquidity created by the prices. This con of unlimited financial can be decreased substantially with correct policy style, the first years will constantly be the worst years with any kind of Whole Life plan.

Nelson Nash Infinite Banking

That claimed, there are specific infinite financial life insurance plans designed mostly for high very early money value (HECV) of over 90% in the first year. Nevertheless, the long-term performance will typically substantially delay the best-performing Infinite Financial life insurance policy policies. Having access to that additional 4 figures in the very first couple of years may come at the expense of 6-figures down the road.

You really get some significant long-lasting advantages that assist you recover these early expenses and after that some. We locate that this impeded early liquidity trouble with boundless financial is much more mental than anything else when completely checked out. Actually, if they absolutely required every dime of the cash missing out on from their limitless banking life insurance coverage policy in the initial few years.

Latest Posts

Infinite Concepts Scam

Be Your Own Bank: 3 Secrets Every Saver Needs

Whole Life Insurance Cash Flow